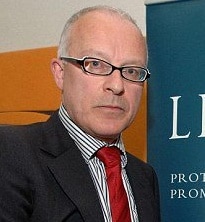

Shiner: Gifted away assets

The liquidator of Public Interest Lawyers will shortly declare a dividend to creditors following the the guilty plea of its disgraced founder, Phil Shiner.

Last week, the struck-off solicitor pleaded guilty to three counts of fraud over legal aid applications for claims against British soldiers accused of ill treatment of Iraqi detainees.

PKF Littlejohn Advisory was originally appointed as PIL’s liquidator in 2017 but director Stratford Hamilton said it was only now that the work could begin to pay money back to creditors, which include a number of government departments.

He explained: “The guilty plea essentially means that any funds that may have been recovered from the Legal Aid Agency are now of course irrecoverable to the company. We issued a claim into the bankruptcy estate of Phillip Shiner in terms of his actions in causing this loss to the company.”

Mr Shiner’s bankruptcy came to an end after six years in 2023. The initial year was extended by a further five in 2018 after he gifted away nearly £500,000 worth of assets to family members before declaring himself bankrupt.

Mr Hamilton said PKF has recovered more than £2.2m. According to PKF’s most recent progress report – for the year to 17 October 2023 – £1m of this is costs recovered from government departments and other third parties.

PIL has no secured and preferential creditors but an estimated £6.1m of unsecured creditors. Some £416,000 of what the report described as ‘priority creditor counsel’s fees’ have been paid out.

The report said it could not issue a notice of intended dividend until no further book debts were recoverable from either the Legal Aid Agency or Government Legal Departments so as to ensure that counsel’s claims were accurate.

PKF has so far taken fees of £316,500 against a total fee estimate of £404,000. The other major costs have been fees of £190,000 for London solicitors Devonshires and £130,000 for NWL Costs Lawyers.

Mr Hamilton added: “The government is not the only victim of Mr Shiner’s fraud, and we will continue to work closely with creditors in what is an incredibly complex and long-running saga.”

Leave a Comment