Search Acumen Conveyancing Market Tracker – Q3 2019 edition

Search Acumen Conveyancing Market Tracker – Q3 2019 edition

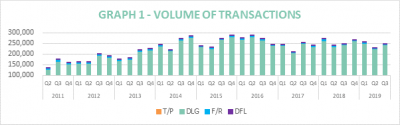

- More than 100,000 fewer transactions were recorded between Q1 and Q3 2019 compared with the same period in 2016

- Quarterly there was an uptick in transaction with volumes up 8% from the lows of Q2 2019

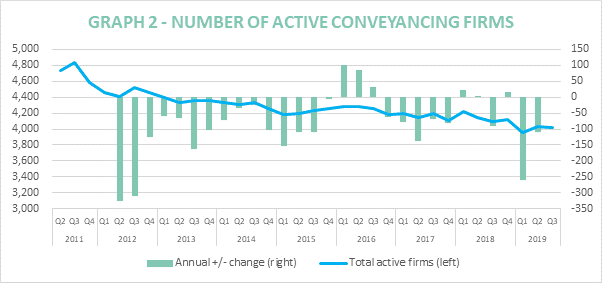

- Number of active firms now at 4,024 – the second lowest quarter on record, and 2% down on one year ago

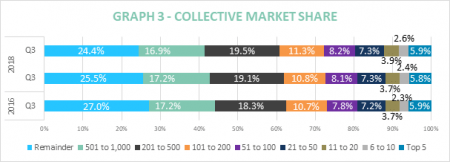

- Largest conveyancers take advantage of a more buoyant Q3 and grip on overall market share intensifies

The conveyancing industry has been forced to react as the market slowdown is aggravated by Brexit uncertainties, according to the Q3 2019 edition of the Conveyancing Market Tracker from Search Acumen, the property data insight and technology provider.

There have been over 100,000 fewer transactions in the first nine months of 2019 compared to the equivalent period in 2016 (731,799 vs 832,684): a 12% drop. Moreover, transactions volumes between Q1 and Q3 2019 are down nearly 4% compared to the same period in 2018 and are down 23% compared to Q1-Q3 2017 (731,799 vs 952,974).

However, while 2019 activity has unfolded at a slower pace, conveyancing volumes are up by nearly 8% quarterly from 228,994 in Q2 to 246,816 in Q3, with a leap of more than 5,500 transactions – more than 10% – for the top ten biggest conveyancers.

A Brexit spanner in the works

The number of active firms dipped slightly from Q2 to Q3 (4,024 vs 4,036) and was the second lowest since the tracker began in 2011. The Q3 2019 total was down 2% compared with Q3 2018 (4,100) and down 6% compared with Q3 2016 (4,260), with almost 250 fewer firms doing business since the EU referendum.

Market consolidation remains the norm

The longer-term trend continues to point to conveyancing consolidation, and there has been a decline of close to 6% in the number of firms processing fewer than 50 transactions a month over the past three years.

The Q3 2019 tracker also found that the top 1,000 conveyancing firms have continued to strengthen their hold on the market. Those firms now control 75.6% of transaction activity, an all-time high.

Larger firms come out on top

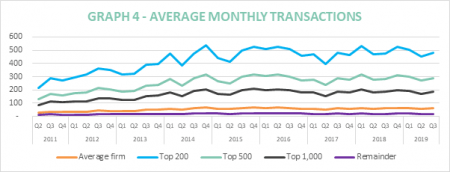

The top 10 firms saw the biggest rise in average transactions from last year by more than 11% over the quarter (4,975 vs 4,468), showing that the biggest firms have been able to claw back more business.

However, the tracker shows that a stronger quarter has not helped ease the impact of longer-term trends. The average number of cases for the top 200 firms was up 9% on the last quarter (1,439 vs 1,317), but average transactions for those firms is down by 8% on three years ago (1,555).

This shows that while the biggest firms have been able to make short-term gains more effectively than smaller firms, Brexit inaction has still hit their monthly business.

Andy Sommerville, Director of Search Acumen, comments:

“Every passing quarter of 2019 has brought more political headwinds to the property market due to Brexit related uncertainty. One hundred thousand fewer transactions so far this year compared to 2016 is an indicator of the ‘Brexit effect’ on an already cooling property market.

“It’s been a tough three years for the industry, but that said, a tricky market has made it clear how effectively large conveyancing firms are now able to win and retain business. But big firms have a physical limit to how much more market share they can gain. There’s only so many conveyancers they can hire to execute so many transactions in a month. We’re going to soon reach an inflection point where the top firms can’t grow without wholesale changes to how they do business.

“To keep growing, bigger firms need to start to think about combining human and digital insights to a greater extent. They need to assess how many transactions they can currently process and investigate what they could be doing if they invested in better technology. Too many firms we speak to see technology as a ‘nice to have’. But it’s more than that now – technology investment is the key to getting ahead in a competitive climate.

“The smart firms are gearing up for more business in the coming quarters because as our recent trackers have proved, the days of the small occasional conveyancer are over. So regardless of market movements, there will be more opportunity out there for bigger conveyancers – the winners will be able to solve how to most effectively handle more volume without over-burdening their conveyancers.”