By Legal Futures Associate Search Acumen

By Legal Futures Associate Search Acumen

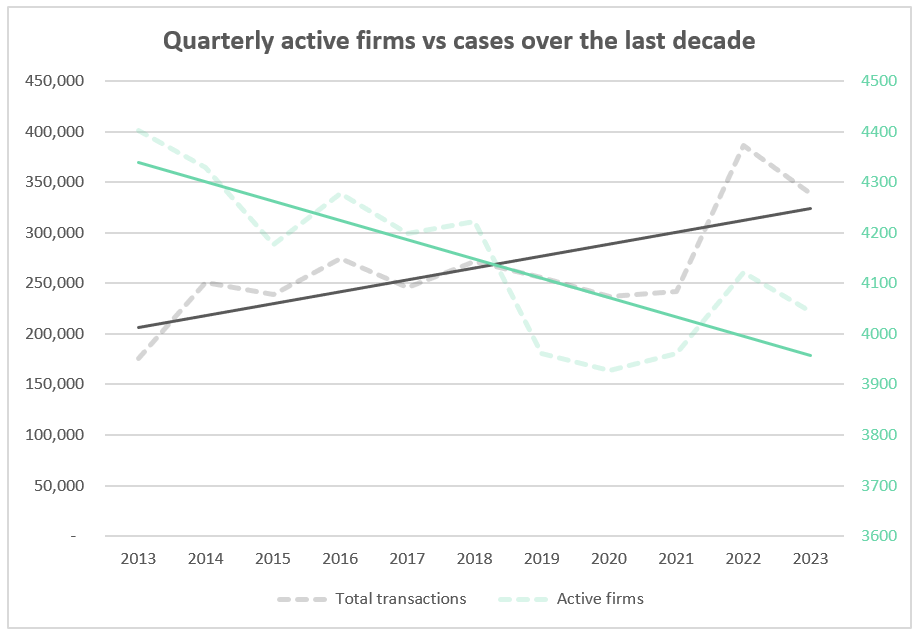

- The average property law firm now handles 84 cases a quarter, more than double the average caseload a decade ago.

- Caseloads are up 9% quarter on quarter, as backlogs create a compounding effect for law firms, but down 12% year on year, reflecting the wider economic conditions.

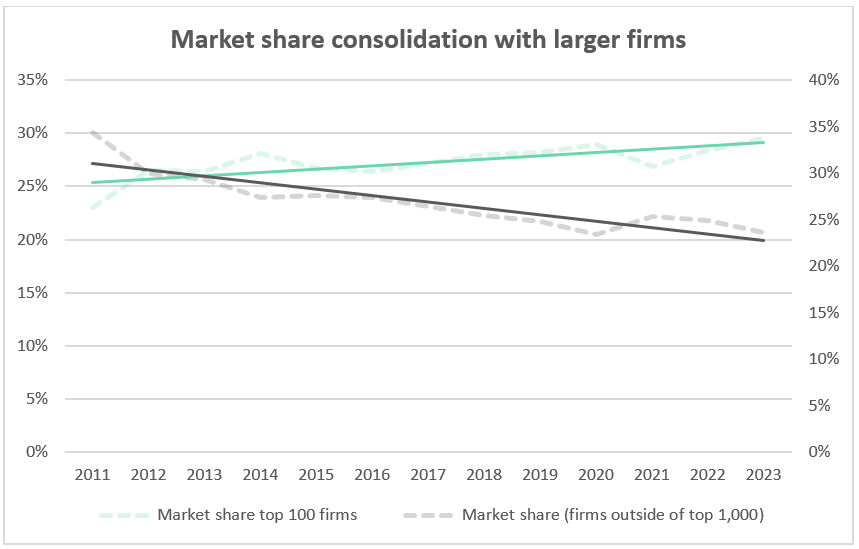

- Larger firms have slowly consolidated their market share over the last decade. The top 100 firms have gained 7% while firms outside the top 1,000 have lost 10%.

The average property law firm handled 84 cases during Q1 2023, an increase of 9% on the previous quarter and the second highest average caseload per quarter since records began in 2011, according to the Conveyancing Market Tracker (CMT) from property data company Search Acumen.

While Q1 figures actually represent a 12% decrease year-on-year, reflecting a slower housing market as economic conditions have stagnated, this annual fall is overshadowed by the long-term shift in market dynamics which has increased pressure on legal practitioners.

Search Acumen’s analysis shows the average firm is handling more than double the number of cases each quarter than it was to a decade ago, when the average quarterly caseload per firm stood at just 40 cases in Q1 2013.

The property law paradox: caseloads at historic highs despite the economic slowdown

The fact that caseloads remain near historic highs, despite the challenging economic conditions, reflects the ongoing imbalance between total case volumes and the number of active firms available to handle them.

Over the last decade, the number of active property law firms has fallen by 8% from 4,402 to 4,045. During the same time period, the average number of cases per quarter has rocketed by 93% from 176,110 to 339,346.

While active firm numbers have now recovered to pre-pandemic levels (increasing by 2% from 3,961 in Q1 2019 to 4,045 in Q1 2023) this rise falls far short of enabling firms to keep pace with the scale of long-term growth in caseloads.

High case levels recorded in Q1 2023 (339,346 across the entire market over the quarter, up 10% on the figures recorded in Q4 2022 and near historic highs) are also symptomatic of significant administrative backlogs in registering property transactions, which means cases continue to stack up on lawyers’ books even if the number of new cases they are processing reduces.

The figures show the scale of task facing conveyancers and HM Land Registry as they fight to catch up following the 2020-2022 property boom, catalysed by the response to the pandemic, and highlights the need for faster digitisation of the legal property process.

Graph 1: total transactions per quarter have increased by 93%, while the number of active law firms has declined by 8%

Andy Sommerville, Director at Search Acumen said: “Even though market activity has slowed in the current economic climate, processing backlogs create a compounding effect, meaning caseloads for property lawyers still remain high by historic standards. This brings about a paradox in that law firms remain incredibly busy almost regardless of wider market conditions.

“Law firms, along with Land Registry and the tech sector, have made great strides in adopting and implementing new technologies to tackle historic backlogs and speed up the process for future transactions. This is having an impact, but more is needed given the sheer scale of the task at hand.

“We are amongst the first in the sector to integrate large language models into our property data and insight platform for clients because generative AI offers huge potential to make transactions more efficient from start to finish. We know firms are starting to engage with this exciting technology, but it is adoption of these innovations at scale that is needed to really move the needle.”

A creeping consolidation of market share by larger firms

Q1 2023 saw the market share of the top 100 firms hit 30%: a level only reached once before, back in 2012.

Since records began in 2011, the top 100 firms have increased their market share of conveyancing work by seven percentage points from 23% in 2011 to 30% in 2023. In contrast, the market share for firms outside of the top 1,000 has fallen by ten percentage points since 2011 when it stood at 34%, compared with 24% in Q1 2023.

In the last two years alone, the top 100 firms have gradually gained market share with an increase of 27% to 30% since 2021.

The growing market share of the top 100 is likely reflective of the resource available to larger firms over the last decade to capitalise on technological innovations at an earlier stage. More recently, in the turbulent years since the pandemic, this first mover advantage will have come into play more significantly as early adopters will have been better placed to navigate these challenging conditions. Conversely these dynamics have compounded the challenges facing SMEs in the sector with less resource to move quickly on technological innovation, or to rapidly implement digital transformation in the face of the unprecedented market conditions.

Andy Sommerville, Director at Search Acumen said: “The last decade has seen rapid advancement in new technologies and larger firms have the resources to invest earlier, gaining first mover advantage. Particularly over the last few years, early tech adopters have been able to capitalise on their capabilities to bolster market share through the volatile years since the pandemic while these conditions have been more challenging for SMEs. Ultimately though, technology levels the playing field and, as the cost of transformative technology, like AI comes down, these tools become more accessible, providing more opportunities for smaller companies to gain a foothold. We are already seeing this happen with large language models like ChatGPT which are being explored by companies of all shapes and sizes.”