Twice as many locations in England and Wales broke the £1bn sales mark in 2018 than 2016

Twice as many locations in England and Wales broke the £1bn sales mark in 2018 than 2016

Search Acumen Commercial Real Estate Insights – June 2019

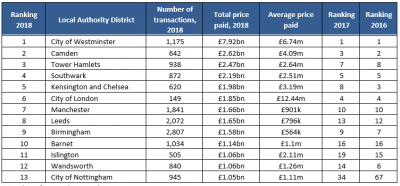

- Thirteen local authority districts across England and Wales exceeded £1bn of commercial real estate sales in 2018, compared with only six in 2016

- Total value of commercial sales jumped by 46% between 2016 and 2018 from £65.7bn to £95.9bn, with transaction volumes rising 22%

- The Billion Pound Commercial Real Estate League has spread beyond London in the last two years: Northern cities join the list as Nottingham made the biggest gains

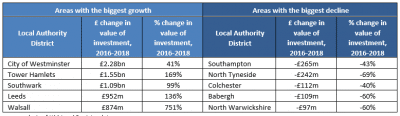

- Beyond Central London, Leeds and Walsall experienced the biggest jump in total commercial real estate transaction values since 2016; Southampton and Tyneside saw the biggest slumps

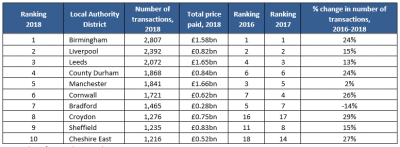

- While London leads in sales values, Midlands and Northern powerhouse cities drive transaction volumes with Birmingham’s commercial transactions up 24% in two years

Commercial sales of real estate exceeded £1bn in 2018 across thirteen local authority districts of England and Wales, as many areas have witnessed rapid growth over the last two years, according to insight analysis from Search Acumen, the property data insight and technology provider.

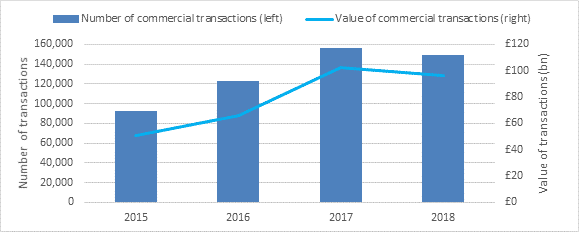

Search Acumen’s analysis of HM Land Registry (HMLR) data shows the total value of commercial transactions rose 46% between 2016 and 2018, from £65.65bn to £95.96bn. The total volume of transactions grew by 22% over the same period from 121,923 in 2016 to 148,965 last year.

This strong activity meant the number of areas across England and Wales boasting a £1bn+ market for commercial sales of real estate has more than doubled, from six in 2016 to thirteen [see notes to editors, figure 5 for a full breakdown for 2016, 2017 and 2018].

However, the data also indicates a potential Brexit slowdown took effect in 2018. Based on transactions logged with HMLR at the end of April 2019, total commercial activity for 2018 was down 4% by volume and 7% by value compared with the previous year, when 15 locations broke the £1bn+ barrier.

The average price of commercial sales also dipped from £632,203 in 2017 to £615,030 last year, although this remained 17% up on the average £525,297 seen in 2016.

FIGURE 1 – TOTAL COMMERCIAL PURCHASES OF REAL ESTATE IN ENGLAND AND WALES, 2015-2018

Source: Search Acumen analysis of HM Land Registry data

Billion-pound commercial real estate league expands beyond Greater London

The six areas of England and Wales to register more than £1bn of commercial real estate sales in 2016 all fell within Greater London. Since then, the list has grown as activity has spread across the country, with Manchester, Leeds, Birmingham and Nottingham each registering £1bn+ of commercial sales in 2018.

The slowdown from 2017 to 2018 saw five areas drop out of the £1bn+ list: Hammersmith and Fulham, Newham, Ealing, Lambeth and Liverpool. The latter was the most notable exclusion having placed 2nd in 2017 for the total value of commercial purchases, before falling to 21st in 2018. Islington, Barnet and Nottingham entered the list in 2018.

The City of Westminster has held the top spot every year since 2015 and boasted almost three times the commercial investment in real estate than in any other area during 2018, with sales exceeding £7bn – more than 8% of the total for England and Wales.

FIGURE 2 – AREAS OF ENGLAND AND WALES WITH £1BN+ OF COMMERCIAL SALES

Source: Search Acumen analysis of HM Land Registry data

London and Leeds see biggest rises in commercial investment, while Southampton slips

Central London locations continue to dominate the list of areas across the whole of England and Wales that have enjoyed the biggest increase in spend on commercial real estate sales since 2016. However, Walsall makes a notable appearance in the top five, having seen a 751% increase (£874m) in commercial real estate spend over two years. Nottingham, which achieved more than £1bn in sales, was the 6th biggest growth area by change in value of investment.

Conversely, among those areas with the biggest fall in overall commercial real estate spend, Southampton saw the biggest drop in value by more than £265m while North Tyneside was hit by a -69% decrease. Both Colchester and its immediate neighbour Babergh also saw big drops of £112m and £109m respectively.

FIGURE 3 – AREAS WITH THE BIGGEST GROWTH AND DECLINE IN SPENDING ON COMMERCIAL REAL ESTATE TRANSACTIONS, 2016-2018

Source: Search Acumen analysis of HM Land Registry data

Northern powerhouse cities drive transaction volumes

Comparing areas of England and Wales by volume of commercial real estate sales, rather than value, Birmingham and Liverpool have held the top two spots since 2016 [see notes to editors, figure 6].

Cities in the Midlands and the North of England are playing an important role in fueling commercial real estate traffic. The top five areas for transaction volumes are all based in the North of England and accounted for 7.4% of all transactions across England and Wales during 2018 (9,758).

The top seven locations for transaction volumes have stayed the same since 2016, with Cornwall showing particularly strong growth in numbers (26%). Outside the top seven, Croydon and Cheshire East have seen the biggest percentage increases of more than 25% to appear in the 2018 top ten.

FIGURE 4 – TOP 10 AREAS BASED ON VOLUMES, 2016-18

Source: Search Acumen analysis of HM Land Registry data

Caroline Robinson, Commercial Real Estate Business Development Manager at Search Acumen, comments:

“The commercial real estate sector has continued to defy expectations since the EU referendum with both valuations and volumes of transactions growing significantly since 2016. Our insights have showed that Greater London’s commercial real estate transactions alone increased by more than 40% in value between 2016 and 2018 – generating an additional £10bn in annual sales – despite the volume only rising by 17% over the same period.

“The overall market slipped back slightly in 2018, which is sure to have been influenced by some investors and developers waiting for a Brexit breakthrough. Nevertheless, our insights paint a picture of a vibrant regional market for commercial real estate business. For example, areas like Walsall and Nottingham have seen a huge increase in the volume and value of commercial properties being transacted in the last two years.

“Looking ahead, the commercial real estate sector faces significant upheaval in the coming years. The demand for retail spaces is shrinking as high street customers move online. Demand for office space is equally on the decline as companies embrace remote working in an effort to reduce overhead costs. At the same time, there is an increasing trend of commercial properties being converted to residential property and brownfield land being redeveloped to boost much-needed urban housing supply.

“Some industry experts are predicting a rise in activity in the commercial sector once the Brexit uncertainty clears, but the longer-term disruption of the market cannot be ignored. Commercial real estate investors will need to innovate if they are to make the most of evolutions in retail, office and residential spaces. Understanding the potential and limitations of developments will be key to maximising profits and moving with wider trends.”