By Andrew Lloyd, Managing Director, Search Acumen

By Andrew Lloyd, Managing Director, Search Acumen

The current property transaction process is riddled with frustration and pain points for everyone. In some regions of the UK, estimates found that buying and selling a house can take nearly eight months. It is a complex and outdated process in need of innovation.

Fortunately, new technology is being implemented to make the process better. Distributed Ledger Technology (DLT), the innovative system that underpins Blockchain, essentially allows many parties to remotely access the same digital documents. A distributed ledger is able to ‘cut out the middleman’ who would traditionally have been the conduit that sends the document from one party to another when each stage of a property transaction is completed. With DLT, the network can function without a central administrator. It allows accounts and documents to only be visible to those that need to see specific records, rather than every item held within the ledger.

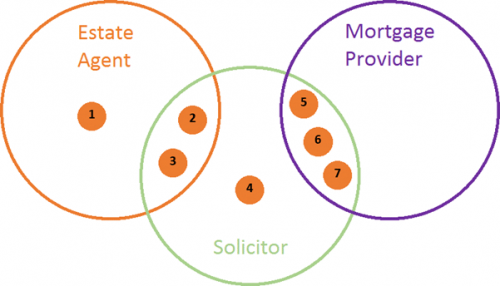

Take for example a mortgage provider, estate agent and solicitor involved in a transaction. DLT would make it possible for mortgage provider and solicitor to have shared ownership of two documents that the estate agent isn’t privy to, while the solicitor and estate agent can view and edit three others the mortgage provider can’t. All of them would also be able to have their own data points only they can see. This way, the solicitor has overview of the process without being dependent on the other parties.

DLT is therefore great for cementing trust and transparency between multiple parties – something the current property transaction process unfortunately lacks. By improving trust, speed, and accuracy, while significantly reducing risk of fraud and human error, this technology could potentially save the global property industry a combined total of $160 billion per annum.

But this isn’t just theory. A recent trial of the Instant Property Network (IPN) in which we were delighted to take part alongside 40 organisations from around the globe, proved that DLT can improve the property transaction process. The trial, which was facilitated by enterprise blockchain software firm R3, ran end-to-end property transactions using test data through a new distributed ledger to simulate property sales over a five-day period.

Over these five days, IPN was able to show how duplications and costly reconciliation processes could be removed from the transaction process; the first transaction, in fact, took only hours to complete. First estimates show that the addition of DLT could speed up the entire process from the buyer making an offer to the completed transaction from an average of three months to less than three weeks.

IPN required partners from every step of the process to simulate their part as closely as possible, and we acted as the first property data provider alongside the likes of Ashurst, Clifford Chance, Baker McKenzie, RBS, and Raiffeisen Bank International in various other roles.